Hong Kong Business News

香港商業資訊

WEALTH SCHEME BROKERS SET

1-11-2024

The China Securities Regulatory Commission and the Securities & Futures Commission of Hong Kong issued announcements respectively today on the first batch of brokers eligible to participate in the Guangdong-Hong Kong-Macao Greater Bay Area Cross-boundary Wealth Management Connect Pilot Scheme.

The Hong Kong Special Administrative Region Government welcomed the announcements.

It said 14 licensed corporations in Hong Kong have been included in the first batch of brokers to offer cross-boundary investment services for bay area investors. These corporations will work in partnership with their Mainland partner brokers as confirmed by the China Securities Regulatory Commission.

The Hong Kong SAR Government also noted that with the first batch of brokers joining the scheme, the demand for asset allocation by bay area residents can be better satisfied, thereby engendering increased development opportunities for the industry.

It also strengthens Hong Kong's status as an international asset management centre, and contributes to the country's opening up of the financial market in a sustained and orderly manner.

The Hong Kong SAR Government added that it is grateful for Mainland and Hong Kong regulatorsâ unwavering efforts.

PREVIOUSNEXT

Latest Business News

最新商業資訊

Loop development outline announced 20-11-2024

The Government promulgated the Development Outline for the Hong Kong Park of the Hetao Shenzhen-Hong Kong Science & T...

Mega events set for 1st half of 2025 19-11-2024

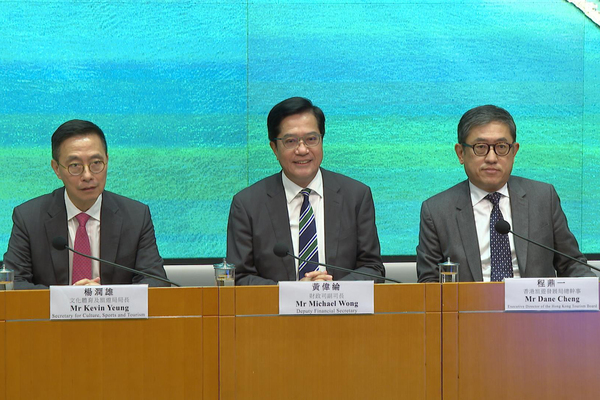

At least 93 mega events will be held in Hong Kong in the first half of 2025, Deputy Financial Secretary Michael Wong anno...

Algernon Yau hosts trade reception 19-11-2024

Secretary for Commerce & Economic Development Algernon Yau today hosted a cocktail reception to update guests on the ...

Vice Premier attends finance summit 19-11-2024

State Council Vice Premier He Lifeng today attended and delivered a keynote speech at the Global Financial Leadersâ ...